Table of Contents:

Introduction to Volume Analysis

Regardless of whether you're a seasoned investor or a novice just stepping into the world of financial markets, understanding the concept of Trading Volume Analysis can be a game changer for your investment strategies. It's an essential tool that sheds light on the market's most intimate details, often revealing what's happening behind the curtains of price movements. Think of volume analysis in trading as the market's heartbeat, illuminating the health and vitality of each market fluctuation.

With volume analysis, you can gain insights into the strength of a price move, identify potential reversals, and understand the vitality within the markets. It offers an asset's perspective beyond its price, delivering a broader and more insightful scope of the market scene. Simply put, TradingVolume Analysis breaks down the 'what', 'when', 'where' and 'why' of trades to deliver comprehensive insights to investors of all levels.

Understanding Trading Volume

The heart of our topic, trading volume, is the total number of shares or contracts traded in a specified timeframe. It exists across all markets - including but not limited to stocks, forex, and the burgeoning world of cryptocurrencies. An individual trading session records high volumes when a large number of securities, shares, or contracts are being bought and sold, and low volumes when the trade activity is minimal.

High trading volume often indicates increased trader interest and heightened activity, suggesting strong trends while low volume might imply weaker trends or even signal a reversal. Therefore, understanding trading volume and its nuances could be your stepping stone toward more profitable trade decisions.

However, the volume alone doesn't tell you the whole story. A holistic volume analysis involves correlating the volume data with price movements to determine the market's true direction. That's where the real 'pulse-check' happens, and understanding this is crucial for those involved in the trading space.

Pros and Cons of Implementing Volume Analysis in Market Strategy

| Pros | Cons |

|---|---|

| Indicates traders' interest level | Can be misleading due to algorithmic trading |

| Useful for predicting price reversals | May not provide accurate signals in illiquid markets |

| Helps understanding market trends | Requires deep understanding and experience |

Importance of Volume in Market Analysis

Taking center stage in our exploration of trading market analysis, volume showcases its absolute importance through several aspects. It primarily provides transparency, allowing traders to gauge the strength of trends and market movements. High trading volumes tend to indicate strong, healthy trends, substantiating the price direction, while low trading volumes may suggest weaker trends or possible reversals.

Volume is also immense in determining market liquidity, an essential trait that affects your ability to enter or exit positions. More transactions mean higher liquidity, enabling easier trading with less impact on price.

In addition, volume data serves as a check against 'false breakouts,' instances where price crosses resistance or support levels without the demand or supply to uphold it. A breakout or breakdown with substantial volume is often a more reliable signal of a new trend. Hence, understanding trading volumes can significantly improve your risk management strategies and open the gateway to savvy trading decisions.

Beyond this, analyzing the volume can also help identify potential trading opportunities that might have been overlooked otherwise. Together with other technical indicators, volume analysis can empower you to master the market's mechanisms and build a robust trading system.

Applying Trading Volume Analysis

To make use of volume as an effective trading tool, one strategy is to watch for volume spikes. An unexpected increase in trading volume can often be a sign of significant market activity which may be worth investigating for potential opportunities. Respective events trigger these spikes, such as product launches, earnings reports, or economic news. Being alert to these elements can offer valuable insights into market behaviour.

On-Balance Volume (OBV) is another powerful tool in volume analysis. This technical indicator adds volume on up-days and subtracts volume on down-days, helping you determine whether money is flowing into or out of a security. Observing OBV, traders can anticipate potential reversals in a price trend.

In the realm of cryptocurrencies, where 24-hour markets and wild volatility are typical, Volume Weighted AveragePrice (VWAP) is often employed. VWAP multiplies the volume of each transaction by the traded price and then averages the values. It provides traders with an overall 'fair' price of the asset, helping create effective entry and exit strategies.

Lastly, Volume price trend (VPT) combines price and volume to show the cumulative flow of money going into and out of a security - it's useful for understanding the intensity of capital flow. High VPT values indicate strong buying pressure, and low values suggest strong selling pressure.

It's essential to bear in mind that volume isn’t a standalone tool, but instead used along with other indicators to provide more depth to your market analysis. By building a comprehensive trading system that uses volume in tandem with price analysis and other tools, you can make more informed and possibly successful trading decisions.

Analyzing Volume Patterns

Another crucial aspect to understand in trading volume analysis is Volume Patterns. These patterns provide significant information about current market conditions and possible future trends. Knowledge of these patterns can tremendously enhance trading strategies.

The most common volume patterns are volume increase, volume decrease, and volume climax. A volume increase usually signifies strong investor interest and may indicate the beginning of a new trend. On the other hand, a volume decrease reflects diminishing interest and can signal the slow downfall of an existing trend.

A volume climax, or the sudden surge in volume towards the end of a price trend, often marks a point of selling saturation or buying climax, which may lead to a trend reversal. Recognizing these climaxes allows traders to anticipate potential reversals and act accordingly.

An intriguing concept is the volume divergence, where the volume pattern veers from the price pattern. This divergence often signals a trend reversal. If the price goes up while the volume goes down, the trend might soon fall. Conversely, if the price drops while the volume rises, the trend could likely rise.

In a nutshell, understanding volume patterns and their divergences can play a pivotal role in the prediction and confirmation of price trends, augmenting the accuracy of your trading decisions.

Combining Volume Analysis with Price Action

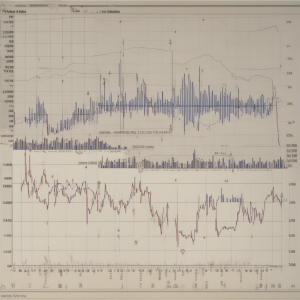

When you bring together volume analysis and price action, you create a powerful duo in the trading world. Price action is the depiction of the variations in an asset's price over time, most often exhibited through candlestick charts. Its an integral part of technical analysis that aids in identifying trade opportunities within the bounds of historical data.

On the other hand, volume analysis provides raw numerical data reflecting the total number of trades executed, offering an overview of the level of trading activity within a particular timeframe. When price action and volume are combined, you can delve deeper into the market's dynamics. You can discern whether buying or selling pressure is driving the price change, thereby translating the market sentiment.

Consider this: a price spike accompanied by substantial volume could indicate strong market agreement about the price move, validating the trend. Conversely, a significant price move on low volume might indicate that the move lacks breadth and may potentially falter, proving to be beneficial warnings for traders.

By integrating price action and volume analysis, traders can better predict price movements, recognise trade setups, and make more informed trading decisions. This amalgamation lends a more holistic view of market dynamics, forms the basis for numerous trading strategies, and ultimately helps mitigate investment risks.

Famous Strategies for Volume Analysis

Now that we have an understanding of how volume analysis works, let's explore some renowned strategies that traders employ to capitalize on this powerful tool.

The Volume Spread Analysis (VSA) is a method that utilizes both volume and price to determine the actions of so-called "smart money". This strategy assumes that high-volume periods often signal the activity of professional traders. By comparing the size of the trading volume bars to the accompanying price action, you can get insights into this smart money's potential moves.

Next is the Shakeouts strategy, designed to discern fake trading signals. Shakeouts occur when professional traders stir up action to force others into making mistakes, such as selling assets prematurely. By analyzing abnormal volumes and sharp price fluctuations, this strategy helps avoid falling into these traps.

We also have Climax Analysis, used to spot the end of a trend. This strategy assumes that climax periods - points when everyone who wanted to buy or sell has done so - coincide with highest trading volumes. After a climax, a reverse in price trend is likely to ensue.

And lastly, there’s the Chaikin Money Flow (CMF), a volume-based oscillator calculating the sum of accumulation/distribution over a certain period. The CMF takes both closing price and volume into account, offering a more comprehensive view of a market’s momentum.

Noteworthy is, each of these strategies leverages the power of trading volume analysis. By using them assiduously, traders can gain significant insights, avoid common pitfalls, and navigate the worlds of stocks, forex, and cryptocurrencies with a greater level of certainty.

Real-life Applications of Trading Volume Analysis

Seeing Trading Volume Analysis in action can significantly improve our understanding of how this tool works. Let's explore some real-life applications where volume analysis makes a noteworthy impact.

First and foremost is the identifying of trends. When there's an increase in trading volume, it's often a clear signal of a strong trend. In real-life situations, this can alert investors to a potential rise in a particular stock or cryptocurrency, suggesting that it would be a good time to enter the market.

Secondly, volume analysis aids in verifying breakouts. Breakouts typically occur when a stock price moves above a defined level of resistance, which often happens due to a increase in demand. Analyzing the volume during such a breakout can help validate if it's a true breakout or a false one. False breakouts, where the trading volume is not substantial, can trap unsuspecting investors which makes volume analysis a crucial tool for risk mitigation.

Volume analysis also proves beneficial when it comes to identifying market reversals. An abrupt drop in volume can often signal a pending market reversal. For instance, if a stock has been in a continuous uptrend, backed by high volume, and then suddenly the volume levels drop significantly - it might suggest that the market is losing momentum and a reversal could be forthcoming.

At a deeper level, advanced traders use trading volume as a part of their algorithmic trading strategies. These strategies, based on price and volume data, generate automated trading signals and execute trades without human intervention. Giving these algorithms the ability to interpret volume data provides them the edge in fouling market trends and exploiting trading opportunities efficiently.

Finally, the sheer breadth of information and insights provided by trading volume analysis applies in many other scenarios, from portfolio management to market prediction, providing versatile use to all classes of investors.

Potential Pitfalls of Volume Analysis

Like all forms of analysis, volume analysis isn't without its share of challenges. It's important to approach Trading Volume Analysis with an understanding of its possible pitfalls to navigate potential missteps effectively. Some of these drawbacks include:

Volume data can be skewed by large traders or institutions. A few large trades can create a surge in volume, making it appear as if there's more broad-based support for a price move than there actually is. Consequently, these outliers can lead to false signals and misinterpretation.

Perceiving volume in isolation is another common pitfall. It is essential to comprehend that volume needs to be analyzed in conjunction with price data or other indicators to establish comprehensive trade strategies. Analyzing volume alone might not provide complete market sentiments leading to inaccurate judgments.

The quality and timeliness of volume data can also pose a challenge. Frequently, volume data are updated with a delay, which can make it less useful for fast-paced trading or short-term analysis. Moreover, inconsistencies or inaccuracies in the posted volume data can throw your analysis off balance.

Understanding these potential risks and challenges can equip you to employ volume analysis more efficiently, and as a more robust tool in your trading toolbox.

Summary and Conclusion on Trading Volume Analysis

In the realm of finance, there are no definitive guarantees. Yet, understanding the mechanics of Trading Volume Analysis certainly strengthens your armoury. The combination of volume and price provides a deeper look into the forces at play, painting a fuller, more nuanced picture of the market's landscape.

From identifying strong trends to revealing possible trend reversals, Trading Volume Analysis delivers a clearer perspective on market activity. It empowers us to spot unique opportunities and assist us in making well-informed decisions— weaknesses in trends, liquidity problems, and falsified breakouts are all made more visible under its lens.

While there is no one-size-fits-all rule on how to best use this tool, a clear understanding of its concepts and potential applications can drastically contribute to your trading strategy. As we continue to inch into a financial era increasingly defined by complex market systems, standing armed with the knowledge of volume analysis-related concepts is likely to be invaluable.

In conclusion, volume analysis complements other indicators and proves to be an instrumental part of technical analysis. It is a tool that lets us listen to the market's heartbeats, providing key insights that help guide our financial journeys. If you're keen about leveling up your trading game, getting to grips with this crucial aspect of the market should be your next stop.

Insight Into Volume Analysis

What is Volume Analysis?

Volume Analysis is a method used in trading which takes into account the volume of securities traded. It is usually used together with price information to confirm market trends and to spot trading opportunities.

Why is Volume Analysis important?

Volume Analysis is important because it provides insights into the intensity of trading, possible trend reversals, and market strength. It is a key factor that signals the interest traders have in a particular market trend.

How is Volume Analysis used in trading?

Traders use Volume Analysis to identify trends and reversals in the market. It can be used to either confirm a current trend or to identify a change in trend.

Which indicators are commonly used in Volume Analysis?

Common indicators used in Volume Analysis include the Volume Oscillator, On-Balance Volume (OBV), Chaikin Money Flow (CMF), and the Average Daily Volume (ADV).

What are some limitations of Volume Analysis?

A limitation of Volume Analysis is that the volume data can sometimes be inaccurate or misleading. Additionally, it can be affected by factors like market volatility and liquidity conditions.