Intrinsic Value

Intrinsic Value

Understanding Intrinsic Value

First off, let's get started by understanding what the term Intrinsic Value means. In the realm of trading, this term refers to the perceived or calculated value of a stock, currency, commodity or any other tradable asset. It plays a pivotal role in making investment decisions.

Breaking Down Intrinsic Value

The Intrinsic Value of a trading asset represents its fundamental worth. It is based on underlying perception and objective calculations rather than the current market price. In other words, the Intrinsic Value captures what investors believe an asset is truly worth. This value stems from a number of intrinsic factors like the asset's earning power, or factors pertaining to the economy and industry the asset exists in.

Intrinsic Value vs. Market Price

Now, you might be pondering, "How does the Intrinsic Value differ from the market price?" Good question! The market price, as the name suggests, is the actual price at which an asset is traded on the exchange. It mostly reflects the collective mood of investors - their fear, greed, and other human tendencies. On the other hand, the Intrinsic Value, calculated rationally, is independent of these market whirlwinds and aims to detect an asset’s true economic worth.

The Use of Intrinsic Value in Trading

So, how can the understanding of Intrinsic Value be applied in everyday trading? When an asset's market price is lower than its Intrinsic Value, it might be a good time to purchase. As the theory goes, the market price will eventually reflect the true worth of the asset. In contrast, if an asset's market price exceeds its Intrinsic Value, it might be overpriced and thus, a selling opportunity.

Calculating Intrinsic Value

Okay, we've come this far and you must be asking, "How do I calculate Intrinsic Value?" Well, that's where things get a bit complex. There are numerous models and methods, like the Discounted Cash Flow model or the Gordon Growth model. Each comes with its own set of assumptions and variables. A good start might be to familiarize yourself with these models and understanding how they handle the specifics of valuation.

Blog Posts with the term: Intrinsic Value

Contrarian traders who went against the prevailing market sentiment in the dot-com bubble and the housing market in 2008 were able to profit from the subsequent downturn. Contrarian trading has the potential to take advantage of market inefficiencies caused by...

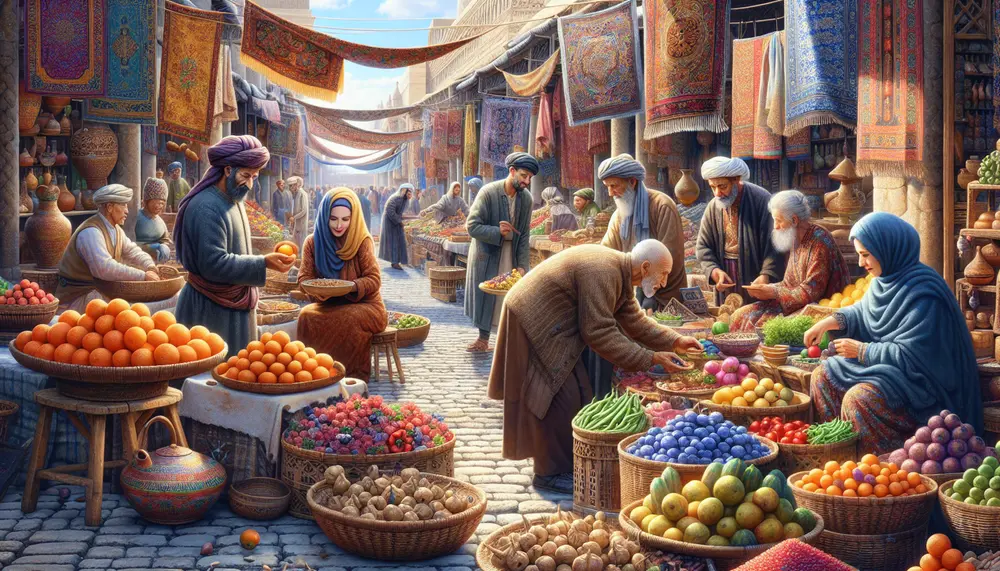

Crypto trading, which involves buying and selling cryptocurrencies like Bitcoin and Ethereum, is being examined for its compatibility with Islamic finance principles. The key question is whether crypto trading can be considered 'halal' (permissible under Islamic law), given that it...

The article discusses the importance of analyzing investments in the volatile world of cryptocurrencies. It introduces two main types of analysis: fundamental analysis, which evaluates the potential value of a cryptocurrency through factors such as its purpose and team, and...

Halal crypto trading aligns with Islamic principles by avoiding interest, uncertainty, and gambling; it requires transparency and ethical practices. Scholars differ on whether cryptocurrencies meet these criteria, necessitating ongoing discourse within the Muslim community to reconcile digital assets with Sharia...

Spot trading in cryptocurrency involves buying or selling assets at the current market price, offering simplicity and immediate ownership without leverage risks. A solid spot trading strategy requires clear goals, diversification, risk management techniques, continuous education, and research to maintain...

Bitcoin trading signals are indicators derived from detailed analysis of past and present price movements, providing insights into market trends and potential profit opportunities. To effectively interpret these signals, traders need to understand both technical and fundamental analyses along with...

Cryptocurrency trading involves exchanging digital assets like Bitcoin and Ethereum to profit from market fluctuations, with the process being secured by cryptography and taking place in a decentralized global market. When choosing an exchange platform, factors such as security, user...

Altcoins are cryptocurrencies other than Bitcoin, each with unique technologies and purposes, introduced to address Bitcoin's limitations or fulfill different market needs. Their relationship with Bitcoin is significant for traders; altcoin performance often correlates with Bitcoin's price movements, which can...

Crypto market analysis involves both qualitative and quantitative methods to assess cryptocurrency markets, focusing on supply-demand dynamics influenced by external factors like economic events and technological advancements. Advanced tools such as candlestick charts, moving averages, and RSI are crucial for...

Cryptocurrency trading requires understanding the 24/7 market, blockchain technology, and factors influencing prices; choosing a secure platform is essential. Balancing risk tolerance with financial goals is key to strategy development, while technical analysis uses chart patterns and indicators for price...

Altcoin trading involves exchanging cryptocurrencies other than Bitcoin, with market forces like supply and demand affecting prices; traders must understand these dynamics and manage volatility in a 24/7 market. Selecting the right altcoins for one's portfolio requires research into fundamentals,...

AAVE is a leading DeFi lending platform that uses blockchain technology to offer transparent, peer-to-peer lending without intermediaries and includes an ecosystem of financial products on the Ethereum blockchain. It provides innovative features like flash loans and rate switching, empowering...

This article introduces the concept of fundamental analysis in the cryptocurrency market. It explains that fundamental analysis involves evaluating the intrinsic value of a cryptocurrency based on factors such as technology, market demand, and regulatory news. It also discusses the...

Bitcoin trading involves buying and selling Bitcoin to profit from price fluctuations, using a decentralized network called the blockchain. Traders must understand market supply and demand, terminology like 'blockchain' and 'wallet', as well as technological updates that can affect prices....

Crypto market analysis involves evaluating factors like market sentiment, technological developments, and regulatory news to understand cryptocurrency price movements; key skills for analysts include analytical thinking, technical proficiency, attention to detail, communication skills, adaptability, and understanding of market trends using...